When's the Optimal Time to Purchase a Home?

- When's the Optimal Time to Purchase a Home?

- Navigating a Seller's Market vs. a Buyer's Market

- Key Considerations When Buying a Home

- How Can You Determine if Now's the Right Time to Buy a House?

- Practical Tips for Homebuyers

1. When's the Optimal Time to Purchase a Home?

On average, March and June emerge as the most favorable months for home purchases. This is largely attributable to diminished competition and potentially more competitive pricing, offering the possibility of acquiring a property below its listed price.

August typically boasts the highest volume of homes on the market, making it an optimal period for those seeking a wide array of options. Conversely, November tends to witness fewer prospective homebuyers, translating to reduced competition and lower home prices. Overall, spring signifies the peak season for home sales, implying a plethora of properties hitting the market, albeit potentially at or above the asking price.

Here's an overview of what to expect during each season when contemplating a home purchase:

Spring: Elevated housing inventory alongside intensified competition and pricing.

Summer: Peak season characterized by a highly competitive market but a broader housing inventory.

Fall: Commencement of declining home prices, offering a heightened potential for price negotiations before winter sets in.

Winter: Diminished inventory and lower home prices.

Examining the housing market in Rhode Island and Massachusetts, home prices in February 2024 witnessed a 5.6% increase compared to the previous year. However, with 4.3% more homes listed for sale and a 3.4% uptick in homes sold compared to the previous year, the market appears to be stabilizing. These statistics suggest that the current climate might be conducive to purchasing a home in Rhode Island and Massachusetts.

2. Navigating a Seller's Market vs. a Buyer's Market

In the realm of real estate, the terms "seller's market" and "buyer's market" hold significant relevance, influencing the dynamics of home buying and selling.

A seller's market denotes a scenario wherein market conditions and housing demand surpass the available supply. In such instances, sellers hold the advantage due to an abundance of prospective buyers relative to available properties.

During a seller's market, homes tend to sell swiftly, often receiving multiple offers. For buyers, navigating a seller's market can be challenging, albeit rewarding for those seeking expeditious transactions.

Conversely, a buyer's market represents a paradigm wherein demand falls short of the available housing supply, affording buyers the upper hand. This typically translates to stabilized or reduced home prices, alongside an array of options and room for negotiation. However, properties may linger longer on the market, which could pose challenges for those in urgent need of relocation.

At present, mortgage rates remain low in Rhode Island and Massachusetts. However, industry experts anticipate an influx of buyers and sellers entering the market. According to the Rhode Island Housing Finance Agency, the current housing market leans towards a seller's market due to limited inventory. Nonetheless, emerging neighborhoods and burgeoning construction projects may tilt the scales in favor of buyers.

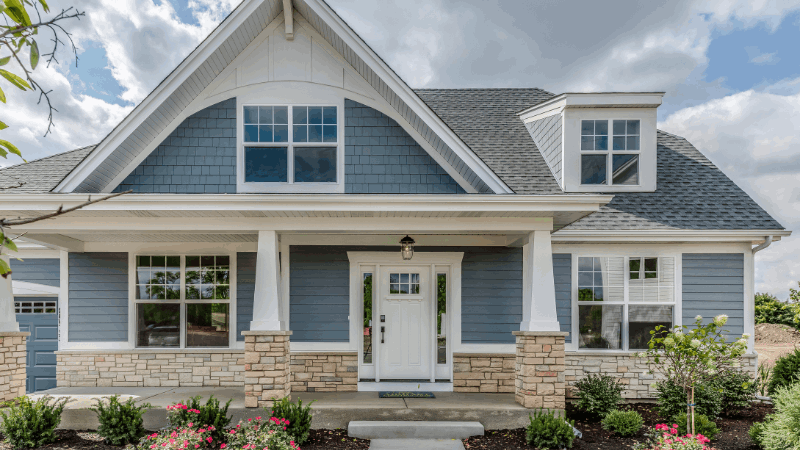

3. Key Considerations When Buying a Home

Numerous factors warrant consideration when embarking on the home-buying journey. Depending on individual preferences, objectives, and life circumstances, certain considerations may carry more weight than others. Here are some crucial aspects that prospective homebuyers should contemplate to facilitate a successful home purchase:

Location

The paramount factor to consider when purchasing a home is its location. Location not only influences property prices but also impacts daily life significantly. Commence your home search by pinpointing one or multiple preferred locations, enabling you to discern favorable deals from suboptimal ones.

Home Size

When selecting a home, bear in mind that you'll likely inhabit it for years, potentially amidst evolving family dynamics. Ensure that the chosen property accommodates your present and foreseeable future needs in terms of bedrooms, bathrooms, and overall living space. Additionally, assess the property's potential for future expansions or renovations to align with evolving requirements.

Price

Price represents a non-negotiable factor in the home-buying equation. Prioritize affordability by assessing your financial capacity, including down payment capabilities and monthly expenditure. Moreover, maintain a financial buffer to account for unexpected expenses and contingencies.

4. How Can You Determine if Now's the Right Time to Buy a House?

Whether you're a renter contemplating homeownership or an existing homeowner eyeing a new abode, evaluating the opportune moment for a home purchase is paramount. Consider the following guidelines to ascertain your readiness for homeownership:

Healthy Credit Score

A robust credit score is instrumental in securing favorable mortgage terms. While some home loans may accommodate borrowers with credit scores as low as 500, higher scores afford access to better interest rates and loan conditions. Ensure that your credit score is optimal to capitalize on advantageous mortgage options.

Affordable Down Payment and Closing Costs

Prior to committing to a home purchase, ascertain that you possess the financial means to cover down payments and closing costs. These expenses typically constitute a percentage of the property's purchase price, necessitating prudent financial planning. Additionally, allocate reserves for deposits, inspections, maintenance, and unforeseen expenditures.

Know What You Want

A clear understanding of your preferences and requirements streamlines the home-buying process. Compile a list of essential and desirable home attributes to guide your search effectively, enabling informed decisions aligned with your needs and preferences.

5. Practical Tips for Homebuyers

Navigating the intricate terrain of home buying necessitates a strategic approach. Employ the following tips to enhance your home-buying journey:

Familiarize Yourself with Your Credit Score

A thorough comprehension of your credit score facilitates informed decision-making and enhances your negotiating leverage.

Embrace Compromise

Flexibility is paramount when exploring home purchase options. Prepare to make compromises while remaining attuned to your non-negotiables.

Plan Ahead

Anticipate potential hurdles and devise contingency plans to circumvent obstacles, ensuring a smoother home-buying experience.

Remain Flexible

Adaptability is key when navigating the dynamic real estate landscape. Stay open to alternative options and be prepared to adjust your preferences as needed.

Leverage the Expertise of a Trusted

Categories

Recent Posts