7 Habits for Home Buying Success

On the search for your next home? You're in the right place! The journey to purchasing a new home can be fraught with stress, but these simple habits can streamline your experience and lead to success.

Home buying is a complex process, whether you're a first-timer or a seasoned buyer. The excitement of moving into a new home comes with its share of stress, and our goal is to help make your transition as seamless as possible.

The housing market is dynamic, and properties often sell quickly. To secure your dream home, you need to act swiftly. Success in home buying involves more than just a few steps; it requires developing habits that set you up for success.

Closing procedures differ from state to state. For instance, homes in Rhode Island & Massachusetts often fetch prices above the asking price, indicating the need for thorough preparation if you're eyeing your dream home in this state.

Mistakes are inevitable, but following this guide can significantly increase your chances of home-buying success.

Continue reading to discover seven key habits for successful home buying.

-

Know Your Credit Score

-

Learn How To Make a Compromise

-

Plan Ahead

-

Be Persistent

-

Educate Yourself on the Home Buying Process

-

Stay Flexible

-

Find the Right Agent

- Know Your Credit Score

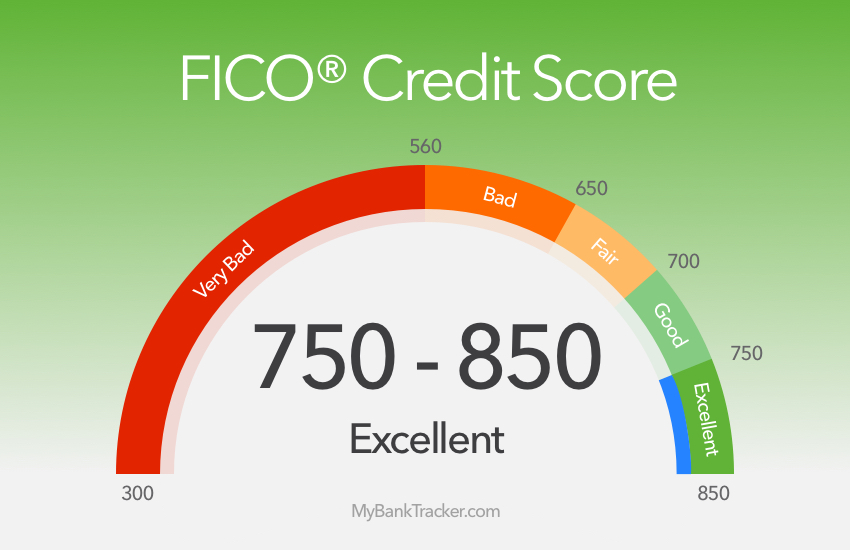

There are various ways to check your credit score, including free websites and banking apps. Regular checks and adjustments are key to keeping your score healthy.

Most favorable mortgage deals are reserved for buyers with excellent credit. Tools like Credit Karma can be invaluable for monitoring and improving your credit score, despite requiring personal information and featuring ads.

If your credit score needs improvement, don't panic. Timely payments and disputing any credit report errors are effective strategies. Consider setting up autopay for consistent bill payments.

- Learn How To Make a Compromise

Saving for a down payment often involves making compromises, whether big or small. Cutting back on daily expenses like coffee or dining out can significantly boost your savings.

When house hunting, compromises are also crucial. You might have to choose between a desirable school district and a beautiful backyard. It's rare to find a home that ticks every box, so be prepared for tough decisions.

For example, reducing a daily $4 coffee habit can save you around $1,460 annually. These savings can be substantial in the long run.

- Plan Ahead

Planning encompasses everything from saving to getting mortgage pre-approval. Be aware of potential changes in your budget due to different living costs and hidden homeownership expenses.

A pre-approval letter is essential to understand your spending limit. Lenders will conduct a thorough credit check, so it's beneficial to review your credit score in advance.

A FICO score above 600 or 700 is generally recommended. Prepare with proof of income and a clean credit report.

- Be Persistent

In competitive housing markets, persistence is key. You may need to make offers on multiple homes before succeeding. Stay determined and keep searching; new listings appear daily.

In markets with rising prices and bidding wars, standing out is crucial. Be creative in your offers and cater to the seller's needs to make your bid more attractive.

- Educate Yourself on the Home Buying Process

Real estate processes vary by state. If you're moving to a new area such as Rhode Island or Massachusetts familiarize yourself with the local home-buying procedures.

Seek advice from experienced real estate agents, especially if you're new to the area. They can provide valuable insights and guidance.

- Stay Flexible

Distinguish between your wants and needs in a home. Flexibility is important, as you might not find a property that meets all your criteria.

Consider expanding your search to different areas, especially with the rise of remote work. While certain features may be non-negotiable, like location or size, be open to compromising on smaller details.

Remember, you can always make improvements to the property later. Focus on the essentials and be willing to adapt your expectations.

- Find the Right Agent

Engaging a real estate agent is a smart move, especially for first-time buyers. Typically, the seller pays the agent's commission, so it's a cost-effective resource for buyers.

Interview multiple agents to find the right fit. A good agent can make a significant difference in your home-buying experience, helping you navigate legal complexities and market dynamics.

FAQ: Habits for Home Buying Success

- How can I be successful in buying a home? Be responsive, research thoroughly, maintain good credit, and surround yourself with knowledgeable people.

- How can I increase my chances of getting a house? Check your credit score, lower your debt-to-income ratio, and save for a down payment.

- What adds the biggest value to a house? Converted basements or attics, and smaller upgrades like new siding or windows.

- What decreases property value the most? Poor neighborhood conditions, lackluster curb appeal, low-quality schools, and obvious repair needs.

- What is the #1 thing that determines the value of a home? Comparable property prices in the area.

Habits For Home Buying Success - The Bottom Line Don't be intimidated by the home-buying process. Patience and diligence are key. Preparation and the right support, particularly from an experienced real estate agent, are crucial.

If you're considering a move to Rhode Island or Massachusetts, there's a lot to consider. Rhode Island's market is dynamic, with properties selling quickly. Working with a knowledgeable agent can help you navigate this market and avoid common pitfalls.

Categories

Recent Posts