How to Build Savings for Your Dream Home While Renting in Rhode Island and Massachusetts

- Consider Downsizing

- Embrace Roommate Living

- Prioritize Debt Repayment

- Trim Unnecessary Expenses

- Pursue a Side Hustle

- Explore High-Yield Savings Accounts

- Allocate Windfalls Wisely

- Leverage First-Time Buyer Programs

- Implement a Budget

- Sell Unused Items

1. Consider Downsizing

Opting for a smaller rental property can significantly boost your savings potential. By downsizing, you can allocate more funds towards your home-buying fund while enjoying reduced rent, utility expenses, and maintenance efforts.

If feasible, moving back in with family temporarily can also expedite your savings journey. Many individuals, especially recent graduates, find this to be a practical strategy for accumulating funds towards their homeownership goals.

2. Embrace Roommate Living

Sharing your rental space with a roommate can effectively halve your living expenses. Splitting rent, utilities, and other costs makes residing in high-cost areas more affordable, allowing you to save substantially towards your future home.

Beyond financial benefits, having a roommate can combat loneliness and foster companionship, making the living arrangement mutually advantageous.

3. Prioritize Debt Repayment

High-interest debts can impede your progress towards homeownership. Focus on paying off outstanding debts promptly to minimize interest payments and free up more funds for savings.

Credit cards, with their exorbitant interest rates, should be a primary target for repayment. Redirect any surplus income towards debt elimination, accelerating your path towards financial freedom.

4. Trim Unnecessary Expenses

Cutting back on discretionary spending can yield significant savings over time. Opt for home-cooked meals over dining out frequently, and embrace low-cost entertainment options like movie nights or game gatherings at home.

Small lifestyle adjustments can accumulate substantial savings, bringing you closer to your homeownership aspirations.

5. Pursue a Side Hustle

A supplementary income stream can substantially bolster your savings efforts. Side hustles offer flexibility and can be pursued outside of regular working hours, providing a viable avenue for earning extra income.

Consider leveraging your skills or interests through tutoring, freelance work, or gig economy opportunities to augment your savings.

6. Explore High-Yield Savings Accounts

Opening a high-yield savings account can amplify your savings through higher interest rates. Research financial institutions offering competitive rates to maximize your savings potential.

In the current economic climate, high-yield savings accounts can provide attractive returns, facilitating faster progress towards your homeownership objectives.

7. Allocate Windfalls Wisely

Bonuses and salary raises present opportune moments to bolster your savings. Rather than splurging on immediate gratification, channel these windfalls towards debt repayment or savings for your future home.

Harnessing unexpected income sources can significantly accelerate your journey towards homeownership.

8. Leverage First-Time Buyer Programs

First-time buyer assistance programs can provide invaluable support in achieving homeownership. In Rhode Island and Massachusetts, various initiatives offer financial aid and incentives to eligible homebuyers.

Explore programs like down payment assistance and mortgage credit certificates to ease the financial burden of purchasing your first home.

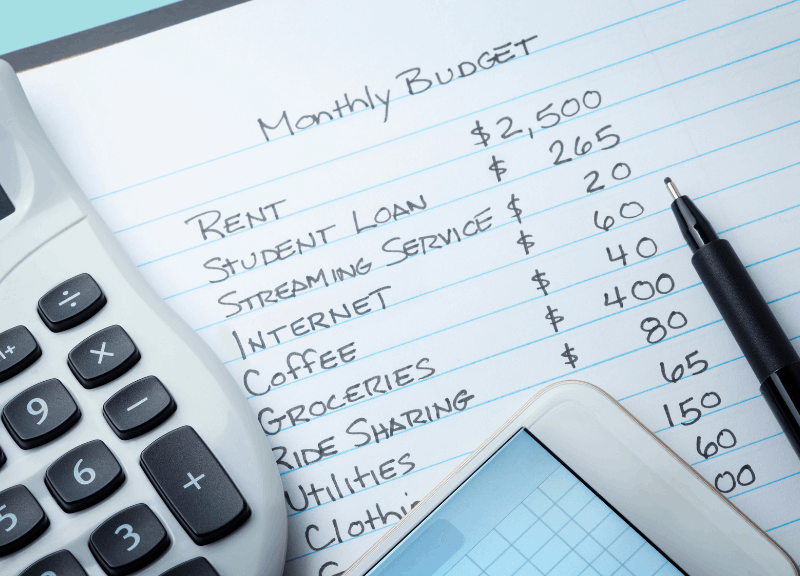

9. Implement a Budget

Creating and adhering to a budget is crucial for effective savings management. Set clear savings goals and allocate a portion of your income towards your homeownership fund consistently.

With disciplined budgeting, you can track your progress and make informed financial decisions, bringing your homeownership dreams closer to fruition.

10. Sell Unused Items

Decluttering your space presents an opportunity to generate additional income. Sell unused or unwanted items through yard sales, online marketplaces, or consignment shops to pad your savings.

By monetizing items you no longer need, you can inject extra funds into your homeownership fund, accelerating your progress towards purchasing your dream home.

Conclusion

Achieving homeownership while renting in Rhode Island and Massachusetts is an attainable goal with strategic savings planning. By implementing these ten strategies and staying committed to your financial objectives, you can expedite your journey towards owning a home in these vibrant locales. For expert guidance on navigating the real estate market in Rhode Island and Massachusetts, reach out to trusted professionals in your area.

Categories

Recent Posts